This article was originally published on bttoronto.ca

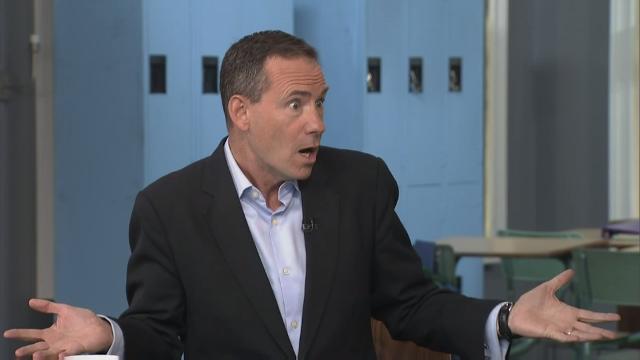

University or college is a great time for one to to expand their mind and to meet new people. However, this might be the first time that young adults are responsible for keeping their finances in check. Many students struggle with staying financially responsible during their first few years of independence, however financial expert Bruce Sellery says students can take several tips to avoid heading into debt.

Make a budget

Many students are not aware of how much money they have coming in, and how much money they are spending. A budget creates much needed financial awareness for students.

Students need to pull out a piece of paper and budget their incoming revenue and outgoing expenses. A budget should include incoming revenue such as RESP money, personal savings, mom and dad, scholarships. Budgets should also include monthly expenses such as school costs such as tuition & books, transportation, rent, phone bills, food, and entertainment. Bruce Sellery stresses that students should be conservative with their spending during the first few years of school, and to place extra money directly into savings.

Address the gap

Most likely, a student budget won’t balance the first time. Never panic! Students have many resources to address the financial gap so they can stay financially stable.

Students can do small things to address a budget gap. Instead of buying brand new textbooks, buying used textbooks will save students up to 50% on course costs. Instead of eating out, students can cook more meals at home. Bruce also recommends looking into financial aid that low-income students can qualify for through their university’s financial aid department.

Don’t be rash with your cash

Keep spending accounts and savings accounts separate. Many students blow through their entire savings when spending is within reach. By having a separate savings account or a tax-free savings account, a student’s entire income is not readily available for spending.

Bruce also says students should not keep a credit card in their wallet. Students can have a credit card, but should pay it off in full, and not carry it with them.

Be wary of marketers

Students are experiencing independence for the first time while attending college or university. Marketers know this! Many credit card companies are directly marketing young students who are financially inexperienced.

Bruce advises students to watch out for offers that seem too good to be true. Understand the risk that credit cards and monthly expenses can have on a student’s budget.